Deltek Costpoint – Timekeeping

ATS uses Deltek Costpoint for timekeeping. This allows employees to input their hours online from any personal computer or mobile device with the Deltek mobile app.

Twice-Monthly Pay Period and FLSA Frequently Asked Questions

ATS is transitioning to a twice-monthly timecard / twice-monthly payroll for several reasons:

- It allows salaried employees the greatest ability to flex their time during the pay period without adding additional administrative burden. This additional flexibility takes on added importance given ATS’s simultaneous changes to workforce categories to comply with the Fair Labor Standards Act (FLSA).

- It reduces the number of times employees need to sign their timesheet from 4 or 5 times per month to 2 times per month.

- It streamlines manager approval and back-office processing of timesheets, allowing for more efficient payroll and faster invoicing of our clients.

This change will go into effect on March 1, 2025. The advantage to this cut-over date is that there is no modification needed to the next two planned pay dates: March 7 and March 21.

Timesheets will now need to be signed twice per month—on the 15th and last day of each month—for all employees. You will receive your paycheck on the 7th or 22nd of each month (except when they fall on a weekend, see Question 6). Time must still be recorded daily per the regulations that apply to all federal contractors.

As we shift to being paid semi-monthly, here are a few things that you should review:

- Direct deposits—if you have money going into bank accounts (savings, money set aside for rent/mortgage, etc.), you may want to review and adjust them.

- 401(k) contributions—The 401(k) contribution will continue to be a percentage of your gross salary; you should still check to ensure you do not reach the cap too early and miss out on the company match.

- Tax setup—If you have a flat amount taken out each check for either federal or state, you may want to adjust as there will be fewer checks with a semi-monthly payroll schedule.

Employees will submit timesheets twice a month by close of business on the last day of the timesheet period (15th or last day of the month). Supervisors must approve timesheets by close of business on the 1st and 16th for the previous timesheet period.

You will receive your paychecks twice per month—on the 7th and 22nd. If the 7th or 22nd lands on a Saturday, you will receive your paycheck on the Friday before, and if it lands on a Sunday, you will receive your paycheck on the following Monday. The 2025 payroll calendar is on the intranet.

You will now receive 24 paychecks in a year, instead of the previous 26.

Pay periods will vary between 72 and 96 hours, depending on the number of weekdays between the 1st through 15th, and the 16th through the last day of the month. For overtime purposes, the work week will begin on Sunday and end on Saturday.

You will continue to receive the same pay on an annualized basis (currently hourly rate x 2080 hours). You will receive two fewer paychecks than you did last year. The 2025 payroll calendar is on the intranet, and note that this change to semi-monthly payroll periods starts 1 March 2025.

- For salaried exempt employees, that base annual figure (current hourly rate x 2080 hours) will be divided by 24 pay periods. For example, if you were earning ~$150,000 on an annualized basis ($72.12 per hour x 2080 hours), your gross pay will be $6,250.00 per pay period 24 times per year versus $5,769.23 per pay period 26 times per year (assuming you were paid for the same number of hours each period). Therefore, for hourly employees who transition to salary, your annual equivalent pay (current hourly rate x 2080) will change to a pay period basis in which your salary (current hourly rate x 2080) will be divided by 24 pay periods. In addition to base pay, employees eligible for “Extended Work Week” pay will continue to be paid for hours worked in excess of the standard number of hours in each pay period.

- For non-exempt employees and for those designated as Computer Professionals (and all those paid hourly), there will be no change to your pay rate. You will continue to be paid for the number of hours worked in a pay period multiplied by your hourly rate.

2025 pay dates will not be affected by corporate holidays.

On an annualized basis, you will continue to accrue the same number of hours under this new pay period schedule. Currently, you accrue PTO based on your annual accrual divided by 26 pay periods. Under the new policy, the accrual will be based on your annual accrual divided by 24 pay periods. PTO will continue to be accrued on each pay date.

| Leave Accrual |

Old Accrual Rate |

New Accrual Rate |

| 120 hours |

4.61 |

5.00 |

| 160 hours |

6.15 |

6.67 |

| 200 hours | 7.69 |

8.33 |

|

Leave In Lieu (LIL) 40 Hours |

1.54 |

1.66 |

The change does not impact how overtime (premium pay) is calculated. For non-exempt employees, any hour worked over 40 hours in a week from Sunday through Saturday will be recorded as overtime.

You will continue to charge your time to the appropriate project/pay type. Any hour worked over 40 hours in a week from Sunday through Saturday will be recorded as overtime eligible for premium pay.

There will be no changes to the projects and/or pay types that are currently used. You will continue to charge your time to the appropriate project/charge code.

How does this change affect exempt employees? Will I be able to flex my time worked in a pay period?

Exempt employees may flex hours within a pay period, subject to contract limitations.

If a direct exempt employee works more than the standard number of hours in the pay period and is approved for “Extended Work Week” pay, they should charge their hours above the standard to the EWW code (and reach out to their supervisor if they do not already have that code on their timesheet).

Exempt employees will need to record at least the minimum number of hours in the pay period. This ranges from 72 to 96 hours, depending on the number of non-holiday weekdays in the pay period. If hours worked during the pay period fall under the minimum number of hours, hours should be charged to PTO, Leave-in-Lieu, previously floated holiday time (in full-day increments), Comp Time, or Leave Without Pay (in 8-hour increments only) to cover any gaps.

More instructions will be provided in the coming weeks.

Like non-exempt employees, you will continue to charge your time to the appropriate project/charge code. Any hour worked over 40 hours in a week from Sunday through Saturday will be recorded as overtime.

There will be no change on how expense reports are handled.

Contribution amounts will be posted to your account over 24 versus 26 pay periods.

No, you will continue using Deltek for timekeeping.

No, this does not change the W2 report format.

Benefit deductions already have been based on 24 pay periods, with the 2 additional pay periods having no deductions. All paychecks will now have benefit deductions at existing rates.

All insurance vendors have been notified. Payroll deductions will be the same annual amount, deducted from each paycheck.

The annual amount remains the same and will be adjusted to reflect 24 versus 26 pay periods. Principal is aware and will re-amortize the amounts. More information is forthcoming.

All salary changes in Paycom will need to be effective either the 1st or 16th of each month.

Over the year, the same amount for taxes will be deducted. However, the amounts will be slightly different from what you have seen in the past.

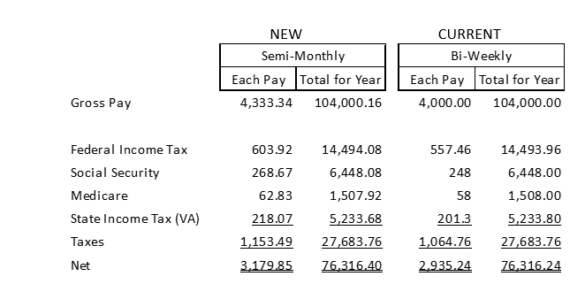

Below is a comparison of a twice-monthly (also referred to as semi-monthly) payroll and every other week payroll for a salaried employee making $104,000 per year ($50/hour):

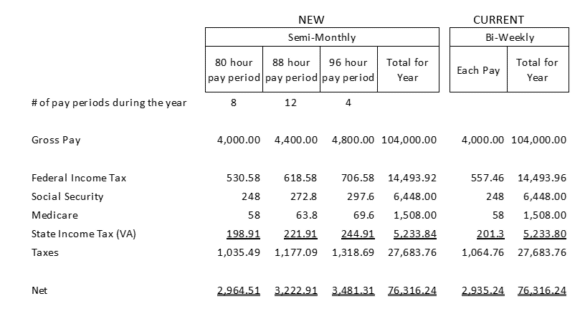

Similarly, here is a comparison of a semi-monthly (twice-monthly) payroll and an every-other-week payroll for an hourly employee making $104,000 per year ($50/hour):

Exempt and Non-Exempt are employee classifications for eligibility for overtime pay and other protections under the Fair Labor Standards Act.

- Exempt employees are not eligible for overtime/premium pay, are often salaried, and typically hold professional or managerial positions.

- Non-Exempt employees are eligible for overtime/premium pay, typically paid hourly, and are covered by FLSA protections.

- https://www.dol.gov/agencies/whd/flsa

We extensively reviewed and discussed the job titles, duties, and roles within programs and followed the FLSA guidelines linked below for categorization.

- https://www.dol.gov/agencies/whd/fact-sheets/17d-overtime-professional

- https://www.dol.gov/agencies/whd/fact-sheets/17e-overtime-computer

At ATS almost all “Professionals” serve as linguists, editors, targeters, TARs, desk officers, intelligence analysts of all types, management and business process analysts/consultants, program integrators and coordinators, or instructors and instructional system designers.

At ATS almost all “Computer Professionals” serve as engineers of all types (software, systems, cloud, network, cybersecurity / information systems, hardware, and data center); system and network administrators; technical support reps and analysts; TDNAs and DNEAs; data scientists; or software testers.

We have been advised by our employment attorney to make the changes to employee categorization to be in line with the Fair Labor Standards Act (FLSA) and to be compliant with the Department of Labor (DOL) regulations. We need to do what is correct and hopefully the impact will end up being minimal.

Companies of all sizes need to be compliant with DOL and FLSA standards. The intent is to be compliant, and not to change the small company feel that ATS strives to maintain. As an employee-owner, this is YOUR company, so please help us keep that small company feel.

Absolutely, please let us know and we can see what is best. You know your job better than we do, so reach out to your PM, DM, or HR and we can talk about how we determined your category to see if a change would make sense. Please let us know in particular if you are categorized as a salaried professional but have concerns about working the standard hours each pay period.

Yes, if you are not in the Salaried Exempt or Computer Professional categories, you are eligible for premium pay. However, you do need to notify your manager and receive approval first.

Please reach out to your PM, Human Resources, or Payroll with questions.

We appreciate your understanding of these changes.

Download the Mobile App

Download the Deltek mobile app to update, submit, and check PTO right from your mobile device.

Don’t see the policy you’re looking for?

Head over to the Employee Handbook for a full record of ATS policies.